Contents:

Ratings analysis incomplete due to data availability. If the last five payouts show variability and are not all growing, we estimate future payouts by applying the lowest growth rate to the most recent payment. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. For ETFs and Mutual Funds, return of capital and capital gains distributions are not included. Learn from industry thought leaders and expert market participants.

It indicates how efficiently the company uses its assets to generate revenue. Return on invested capital measures how effective a company is at investing its capital in order to increase profits. It is calculated by dividing the EBIT (Earnings Before Interest & Taxes) by the average invested capital in the previous year.

Solitario Zinc Corp. (XPL)

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. Realtime quote and/or trades https://day-trading.info/ are not sourced from all markets. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

Management and Directors hold approximately 9.6% of the Company’s 58.2 million shares outstanding. Solitario’s cash balance and marketable securities stand at approximately US$7.9 million. Solitario Zinc Corp. is a mineral exploration company, which focuses on the acquisition of precious and base metal properties with exploration potential, and the purchase of royalty interests. Its projects include Florida Canyon in Peru, Lik Zinc in Alaska, and La Promesa in Peru. The company was founded on November 15, 1984 and is headquartered in Wheat Ridge, C…

- Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers.

- Insiders that own company stock include Christopher E Herald and James Kb Hesketh.

- Join thousands of traders who make more informed decisions with our premium features.

- It measures cash spent on long-term assets that will be used to run the business, such as manufacturing equipment, real estate and others.

H.C. Wainwright analyst Heiko Ihle reiterated a Buy rating on Solitario Exploration & Royalty (XPL – Research Report) today and set a price target of $0.90. The company’s shares closed yesterday at $0.53.Ihle covers the Ba… Wainwright reiterated a Buy rating on Solitario Exploration & Royalty (XPL – Research Report), with a price target of $0.90.

XPL Stock 3-Year Chart

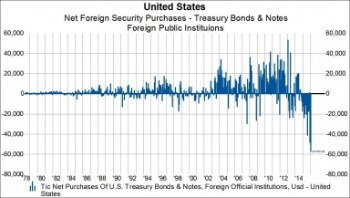

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. We’d like to share more about how we work and what drives our day-to-day business. the bond and foreign exchange markets 2020 Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures. H.C. Wainwright analyst Heiko Ihle reiterated a Buy rating on Solitario Exploration & Royalty (XPL – Research Report) today and set a price target of $0.90.

No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. Discuss news and analysts’ price predictions with the investor community. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Other market data may be delayed by 15 minutes or more. Solitario Zinc’s stock is owned by a number of retail and institutional investors.

T-bills are subject to price change and availability – yield is subject to change. Past performance is not indicative of future performance. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates.

SOLITARIO ZINC CORP. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – Marketscreener.com

SOLITARIO ZINC CORP. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Thu, 16 Mar 2023 10:05:18 GMT [source]

Earnings per share is the portion of a company’s profit that is allocated to each individual stock. Diluted EPS is calculated by dividing net income by “diluted” shares outstanding. Return on equity is a profitability metric that shows how efficient a company is at using its equity (or “net” assets) to generate profits.

Solitario Zinc Stock Earnings

Capital expenditures are also called payments for property, plants and equipment. It measures cash spent on long-term assets that will be used to run the business, such as manufacturing equipment, real estate and others. Total debt is the total amount of liabilities categorized as “debt” on the balance sheet. It includes both current and long-term (non-current) debt.

See Jiko U.S. Treasuries Risk Disclosures for further details. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured.

What is the 52-week high for XPL stock?

This means that if you invested $100 now, your current investment may be worth 77.628$ on 2024 March 17, Sunday. Profit margin is the percentage of revenue left as net income, or profits, after subtracting all costs and expenses from the revenue. The inventory turnover ratio measures how many times inventory has been sold and replaced during a time period. The EV/EBIT is a valuation metric that measures a company’s price relative to EBIT, or Earnings Before Interest and Taxes. The EV/EBITDA ratio measures a company’s valuation relative to its EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization.

It can be seen as the amount of money held by investors inside the company. It is calculated by subtracting all liabilities from all assets. Net Cash / Debt is an indicator of the financial position of a company. It is calculated by taking the total amount of cash and cash equivalents and subtracting the total debt. The current ratio is used to measure a company’s short-term liquidity.

Valuation Ratios

A low number can indicate that a company will have trouble paying its upcoming liabilities. The enterprise value to sales (EV/Sales) ratio is similar to the price-to-sales ratio, but the price is adjusted for the company’s debt and cash levels. The price-to-book (P/B) ratio measures a stock’s price relative to book value.

These are established companies that reliably pay dividends. Solitario Zinc saw a increase in short interest in the month of February. As of February 28th, there was short interest totaling 97,600 shares, an increase of 29.3% from the February 13th total of 75,500 shares.

The company’s earnings for a period net of operating costs, taxes and interest. Solitario reports results from Spur area in Geyser Gold Zone Solitario Zinc reports that it has received results from a new high-grade gold area, called Spur, south of… Netcials reports section helps you with deep insights into the performance of various assets over the years. We are constantly upgrading and updating our reports section. Build conviction from in-depth coverage of the best dividend stocks. Robinhood gives you the tools you need to put your money in motion.

See Best Materials Dividend Stocks Model Portfolio for our top income & growth blend ideas in Materials. See Best Dividend Stocks Model Portfolio for our top income & growth blend ideas. See Best Monthly Dividend Stocks Model Portfolio for our top monthly income ideas.

0 Comments